VAT Number Lookup Saudi Arabia

In Saudi Arabia, it is mandatory for businesses to register for Value Added Tax (VAT) and obtain a VAT number if they have a certain level of turnover. However, the process of finding your VAT number can be confusing, especially if you only have your Commercial Registration (CR) number. In this article, we will provide a comprehensive guide on how to locate your VAT number in Saudi Arabia using your CR number. By the end of this article, you will have a clear understanding of the process and be able to confidently and easily find your VAT number.

How to find VAT Number in Saudi Arabia

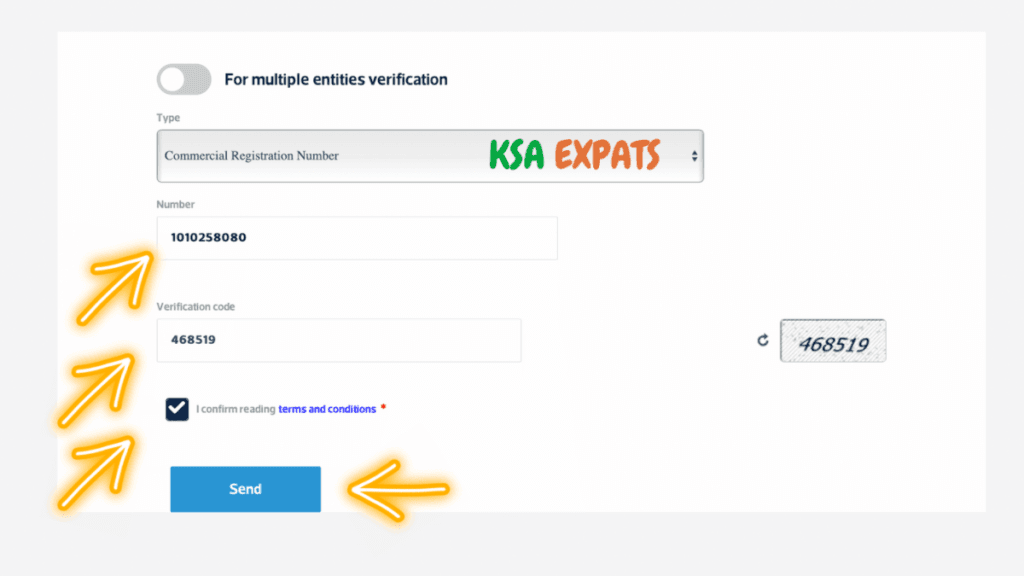

You can now easily locate the VAT number of any business by utilizing their Commercial Registration (CR) number on the Zakat, Tax and Customs Authority (ZATCA) website. The following are the step-by-step instructions to do so:

- Go to the ZATCA portal: https://zatca.gov.sa/en/eServices/Pages/TaxpayerLookup.aspx

- Choose “Commercial Registration Number” as the type.

- Enter the “CR Number” and image code.

- Check the terms and conditions box, then click on the “Send” button.

- Upon proceeding to the next page, you will be able to view the business name, the status of VAT registration, and the VAT account number.

Conclusion

In conclusion, finding your VAT number in Saudi Arabia using your CR number is a relatively straightforward process. By following the steps outlined in this article, you should now be able to confidently and easily find your VAT number. It is important to note that having a valid VAT number is essential for businesses operating in Saudi Arabia, and the failure to obtain one can result in penalties. By understanding the process and being aware of the importance of having a valid VAT number, businesses can ensure compliance with the regulations set forth by the Zakat, Tax and Customs Authority (ZATCA).

More from KSAexpats.com: