End of Service Benefits in Saudi Arabia

When an employment contract comes to an end in Saudi Arabia, it is important to understand how to calculate the end-of-service benefits that the worker is entitled to. These benefits are meant to provide financial support to the employee after their service with the employer has ended. Let’s take a look at how these benefits are calculated according to the Saudi labor law.

Calculation of the End-of-Service Benefits

The end-of-service benefits is based on the worker’s last wage and is calculated as follows:

- For the first five years of service, the worker is entitled to a payment equal to half a month’s wage for each year.

- For the subsequent years beyond five years, the worker is entitled to a payment equal to one month’s wage for each year.

Resignation and End-of-Service Benefits

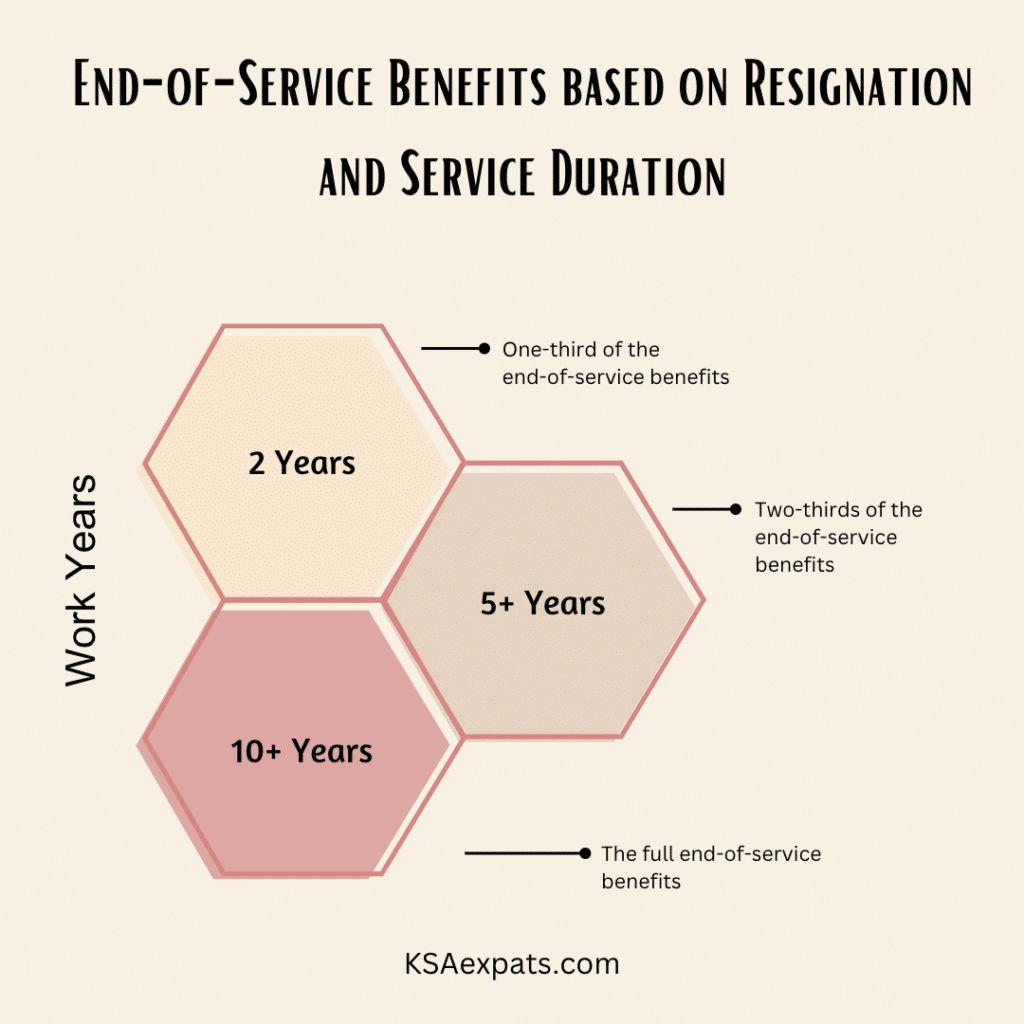

If the worker resigns and their service period is less than two years, they will not be eligible for the end-of-service award.

- If the worker resigns and has completed at least two years but less than five years of service, they will be entitled to one-third of the award.

- If the worker resigns and has completed more than five years but less than ten years of service, they will be entitled to two-thirds of the award.

- If the worker resigns and has completed more than ten years, they will be entitled to full end-of-service benefits.

Special Cases

- Female workers who end their service within six months of their marriage or three months after giving birth are entitled to the full end-of-service award.

- If the worker leaves their job due to a force majeure event, they are entitled to the full award.

- The employer and the worker can agree that certain wage components like commissions or percentages will not be included in the calculation of the end-of-service award.

Definition of Wage

The term “wage” refers to the basic salary along with any other increases or allowances that the worker receives for their effort, the risks they face in their work, or as determined by the employment contract or labor regulations.

It is important to note that the end-of-service award is considered a worker’s entitlement, and the employer is obligated to pay it upon the termination of the employment contract, whether it is for a fixed or non-fixed term.

End-of-Service Benefits for Domestic Workers

Domestic workers in Saudi Arabia are entitled to an end-of-service award of one month’s wage if they have provided continuous service to the employer for a period of four years.

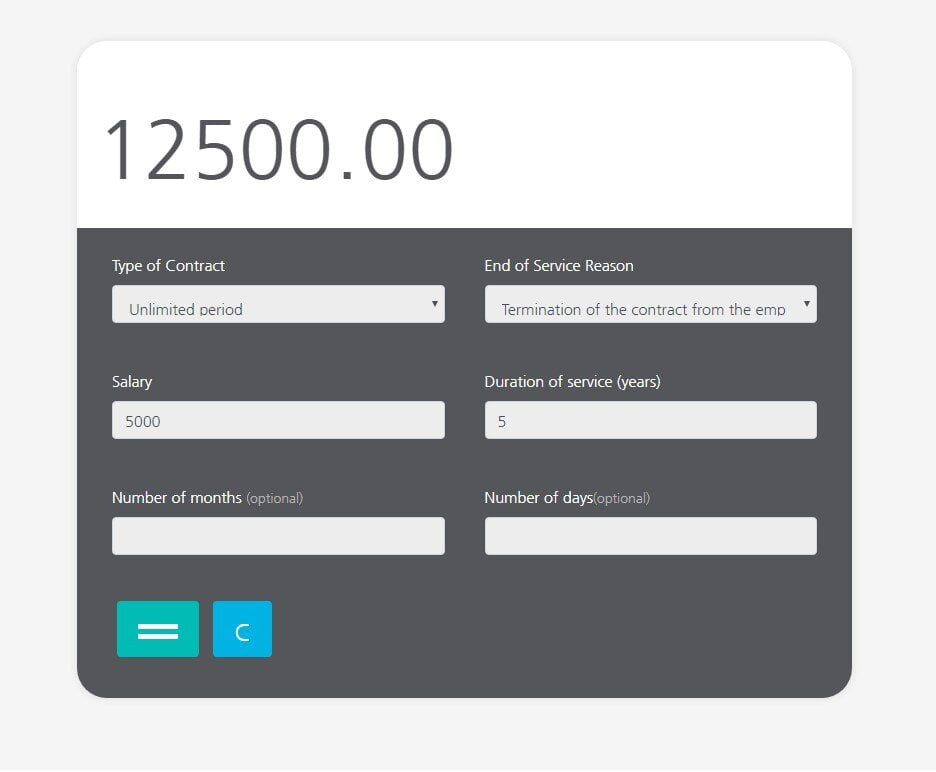

How to Calculate ESB Using MHRSD’s End of Service Calculator

Calculating your End-of-Service Benefits (ESB) in Saudi Arabia is a straightforward process with the help of MHRSD’s End of Service Calculator. Follow these steps:

- Visit the End of Service Calculator page: https://laboreducation.mlsd.gov.sa/en/calc.

- Select your “Type of Contract” – either “Fixed Time” or “Unlimited Period.”

- For Fixed Time contracts, choose one of the “End of Service Reasons” that applies to your situation.

- For Unlimited Period contracts, select one of the “End of Service Reasons” listed.

- Enter your basic “Salary.”

- Enter the “Duration of Service” in years (you can also enter months and days if necessary).

- Click on the “Green Button” (equal sign).

- The calculator will display your End of Service Benefits (Gratuity) at the top.

Note: Article (80) of the Saudi Labor Law lists the cases in which the employer can terminate the contract without an award, notice, or indemnity. Article (81) outlines the situations in which a worker can leave their job without notice. These articles provide further context regarding the termination of employment.

By following these steps, you can easily calculate your End-of-Service Benefits using MHRSD’s calculator. It’s a user-friendly tool that helps ensure you receive the accurate entitlements you deserve.

FAQs

Yes, the employer has the right to deduct any debt owed to them by the worker from the amounts owed as stated in Article (87) of the Labor Law.

According to Article (86) of the Labor Law, it is possible to agree not to include commissions and certain wage components subject to increase or decrease in the calculation of the wage used for end-of-service benefits.

Yes, according to Article (87) of the Labor Law, if a worker resigns due to circumstances and force majeure that forced them to resign, they are entitled to the full end-of-service benefits.

Yes, according to Article (87) of the Labor Law, a female worker who terminates the contract within six months of her marriage contract or three months after giving birth is entitled to the full end-of-service benefits.

According to Article (87) of the Labor Law, if the worker’s service ends, the employer must pay the wages and clear the worker’s rights within a week at most. If the worker is the one who terminated the contract, the employer should fully clear their rights within a period not exceeding two weeks.

In cases of force majeure, the employer can agree with the worker, within six months, on certain measures such as reducing the worker’s wage, granting leave, or taking exceptional measures, as stated in Ministerial Decree No. (70273). The work contract cannot be terminated after that if the employer has received government aid to face the situation.

Conclusion

In conclusion, understanding how to calculate end-of-service benefits is essential for both employers and workers in Saudi Arabia. By following the guidelines set forth in the Saudi labor law and utilizing resources like the MHRSD’s End of Service Calculator, the process becomes more accessible and transparent. Whether you are an employer fulfilling your obligations or an employee ensuring you receive your rightful entitlements, the calculation of end-of-service benefits plays a significant role in maintaining a fair and just work environment. By familiarizing yourself with the rules and procedures outlined in this article, you can navigate the calculation process with confidence and ensure a smooth transition when the employment relationship comes to an end.

More Articles from KSAexpats.com: