What is Mobily Pay

Smartphone technology has made life easier for us, but now it’s time to simplify things with Mobily Pay. Mobily Pay, the newest digital wallet from Mobily, is a new payment service licensed by the Saudi Central bank (SAMA) that lets you make financial transactions such as money transfers, purchases, and bill payments with just one tap.

What features does it offer?

The new Mobily Pay features are designed to make your life easier and more convenient. With a digital Visa card, you can now make payments online. The wallet-to-wallet transfer feature allows you to send money to anyone. You can also make local (SARIE-IPS) and international transfers (to an account, cash pickup, or wallet), SADAD payments, and Mobily payments. Plus, you can send gifts and schedule payments. So whether you’re paying for everyday expenses or sending money to friends and family abroad, Mobily Pay makes it easy and convenient. Try it today!

How do I use it?

To use Mobily Pay, first download the app from the App Store or Google Play. Then create an account and add your credit or debit card information. That’s it! You’re ready to start using Mobily Pay.

Mobily Pay Digital Cards

Mobily pay offers three digital cards for payments, a classic card, a platinum card and a signature card. The classic card comes with 0.5% cashback with no annual fees. The platinum card offers 0.7% cash back on spending with a yearly charge of SAR 100 plus 15% VAT. The signature card offers 1% cash back on spendings with an annual fee of SAR 400 plus 15% VAT. With these three options, you can choose the card that best suits your needs and lifestyle.

Also Read: 7 Top Money Transfer Services in Saudi Arabia

How to issue Mobily Pay digital cards?

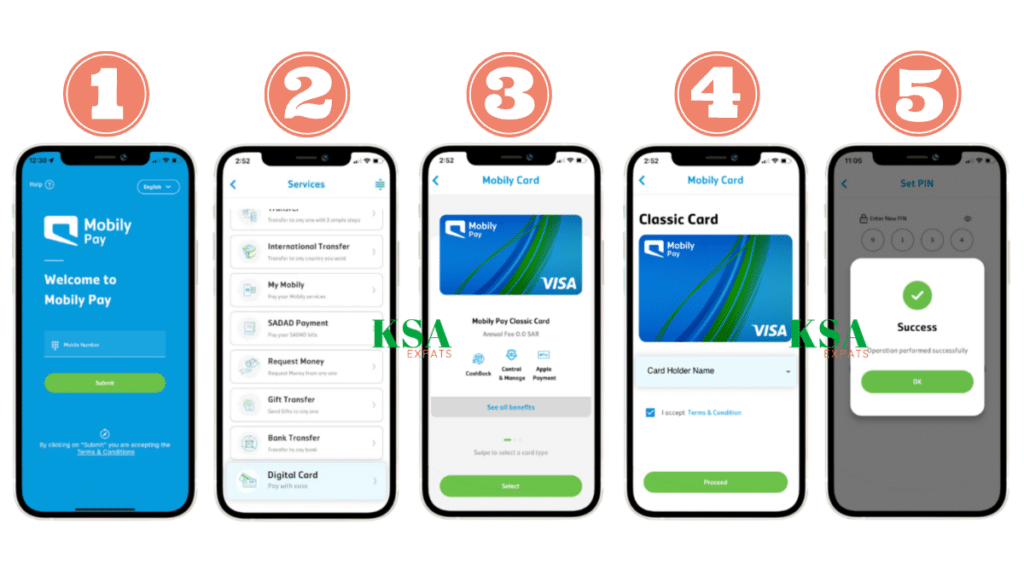

You can now issue digital cards through Mobily Pay in just 5 simple steps:

- Login to your Mobily Pay wallet

- Choose “Card Issuance” from the list of Services

- Choose the type of card you want

- Choose how you want your name to appear on the card

- Confirm the card issuance That’s it!

Mobily Pay Free International Money Transfer Offer

Are you looking for a way to send money internationally without any fees? Look no further than Mobily Pay’s newest offer! For a limited time, they are offering free international transfers plus 10 SAR cashback. This offer is only valid for transfers made through MoneyGram, so be sure to take advantage of it while you can. The Offer is valid until November 10, 2022, and the cashback will be deposited within 72 working hours after the beneficiary receives the amount. The minimum send amount to get this offer is 600 SAR per transaction, so make sure your transfer meets that criteria.

Conclusion

Mobile pay is a great way to make your life easier and more convenient. With this, you can quickly and easily pay for your purchases without having to fumble around with cash or cards. Plus, mobile pay is generally more secure than traditional methods of payment, so you can rest assured that your information is safe. If you’re not already using this payment app, we recommend giving it a try — you might just find that it’s your new favorite way to pay!

Also Read: How to Transfer Money To An International Bank Account Using STC Pay