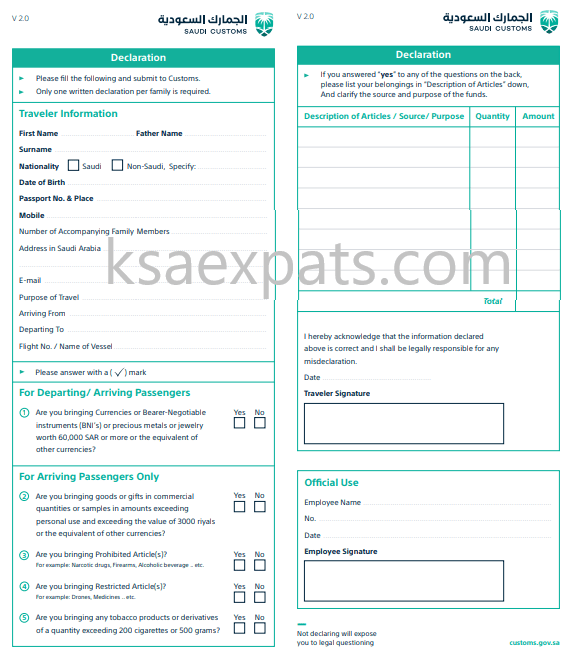

Customs Declaration in Saudi Arabia

Now it is a compulsory procedure for each traveler coming and going from Saudi Arabia, in case they have any currency, monetary instruments, gold bullion’s or precious metals, precious stones, fine jewelry valued at SR60,000 or more they must fill up and submit a customs declaration form.

This procedure is in accordance with the provisions of Article 23 of the Anti-Money Laundering Law issued by Royal Decree (M / 20) dated 5/2/1439 H. Also, goods which are subject to prohibition, restriction or taxes and fees, shall be disclosed, in accordance with the provisions of Article 60 of the Common Customs Law ratified by Royal Decree (M / 41) dated 3/11/1423.

Customs Declaration Procedure in Saudi Arabia

The traveler shall fill out and sign the declaration form and attach what verifies the accuracy of the information provided. This form is available at all entry and exit points of the Kingdom as well as on the Customs website.

In the air and sea ports, these offices are located after the flight registration counters before entering the departure lounge. For arrivals, the offices are after passports control. At land ports, the offices are located before the Customs checkpoint of the arrivals and before the check-out offices of the departures.

Penalties and Fines for non Declaration

What will happen if I fail to submit a declaration while carrying an amount that is equal to or exceeds SR 60,000?

A monetary fine of 25% of the seized value is imposed for the first violation and 50% of its value for repeat violation.

What are the consequences if I don’t declare prohibited or restricted items?

All these materials and items will be confiscated, customs fine will be imposed, and you will be referred to the relevant authorities in the event of carrying prohibited materials.

Source: Saudi Customs