HDFC NRI Account Opening from Saudi Arabia

Opening a bank account in India as an NRI (Non-Resident Indian) can be a daunting task, especially when you’re located in a different country. However, with HDFC Bank’s online banking options, it’s now easier than ever to open an NRI account from the comfort of your own home, even if you’re located in Saudi Arabia. This guide will walk you through the process of opening an HDFC Bank NRI account online, ensuring that you have all the necessary documents and information ready before starting the process.

Exploring the Various Account Options Available for NRIs at HDFC Bank

When it comes to banking as an NRI (Non-Resident Indian), HDFC Bank offers a range of account options to suit your needs. Some of the account options available for NRIs at HDFC Bank include NRE (Non-Resident External) Accounts, NRO (Non-Resident Ordinary) Accounts, and FCNR (Foreign Currency Non-Resident) Accounts. NRE Accounts are ideal for NRIs who wish to keep their savings in Indian Rupees, while NRO Accounts are best suited for those who earn income in India and wish to keep it in Indian Rupees. FCNR Accounts, on the other hand, are ideal for NRIs who wish to save their funds in foreign currencies. It’s important to understand the features of each account type and the difference between them before opening an account, so you can choose the one that best suits your financial needs.

Required Documents to Open an NRE Savings Account with HDFC Bank

To open an NRE Savings Account with HDFC Bank from Saudi Arabia, the following documents are required:

- A copy of your Iqama or residence permit

- A passport-sized photograph

- Copy of your passport pages that display passport details and personal information

- A copy of the Permanent Account Number (PAN) or Form 60 (if PAN is not available)

- A document that verifies your Saudi or Indian address, which must match the address provided on the application form

- An initial payment cheque or draft from your account is equivalent to the amount needed to maintain the average monthly balance in the NRE savings account. If a draft is used, a DD slip is mandatory.

How to Open an HDFC Bank NRI Account Online from Saudi Arabia

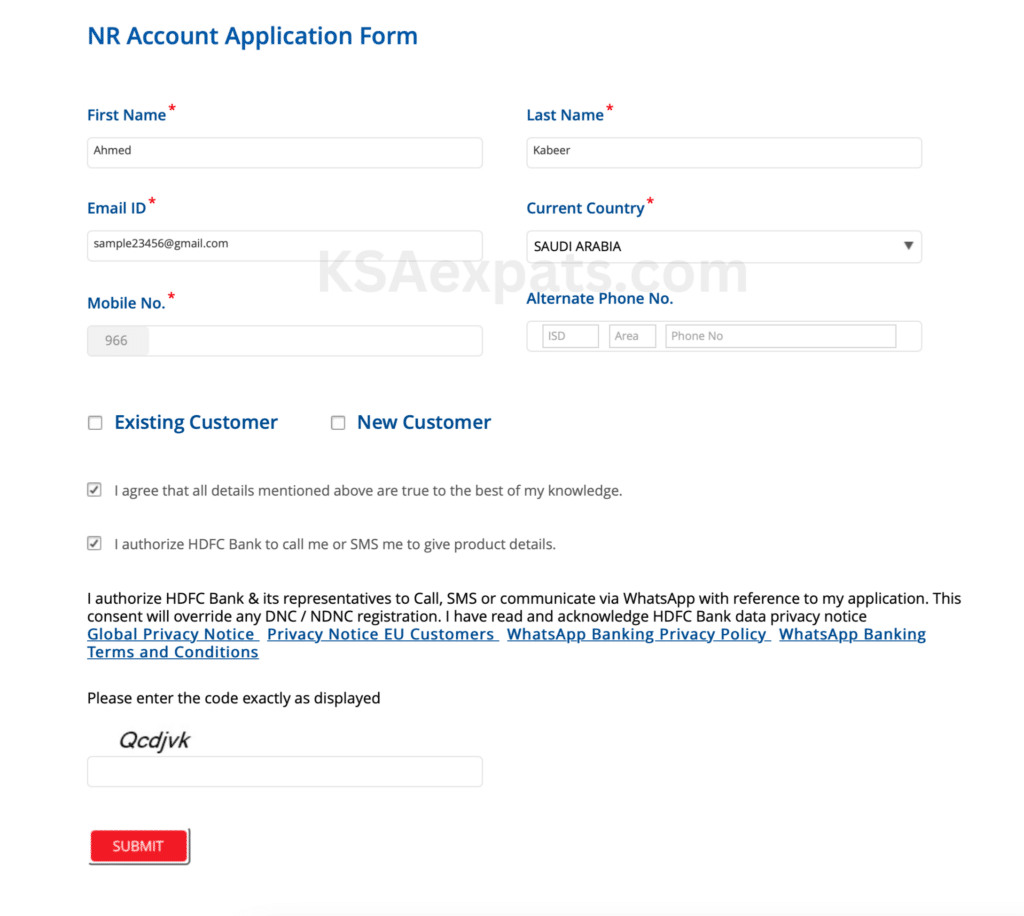

Opening an HDFC Bank NRE Account from Saudi Arabia is now possible through the bank’s online platform.

- To begin the process, you can fill out the NRE/NRO account online application form with all the necessary details.

- Once the form is submitted, an HDFC Bank representative will contact you to guide you through the account opening process.

- The necessary KYC documents will have to be self-attested for existing HDFC Bank customers, while new customers will have to get them attested by a designated authority before submitting them.

HDFC Bank NRE/NRO Account Minimum Balance Requirement

HDFC Bank has set minimum balance requirements for NRE (Non-Resident External) and NRO (Non-Resident Ordinary) accounts. These requirements vary depending on the location of the branch where the account is opened. For metro and urban branches, the Average Minimum Balance (AMB) is set at Rs.10,000, or a fixed deposit of Rs 1 Lakh for a minimum 1 year and 1 day period. For semi-urban branches, the AMB is set at Rs.5,000, or a fixed deposit of Rs 50,000 for a minimum 1 year and 1 day period. And for rural branches, the Average Quarterly Balance (AQB) is set at Rs.2,500, or a fixed deposit of Rs 25,000 for a minimum 1 year and 1 day period. It’s important to note that if the minimum balance requirement is not met, the account holder will be charged penalties. It’s recommended to check with the bank regarding the current minimum balance requirements and penalties, as they may change in time.

Conclusion

In conclusion, opening an HDFC Bank NRE (Non-Resident External) or NRO (Non-Resident Ordinary) account from Saudi Arabia is a straightforward process that can be completed online. With the help of this guide, you should have a clear understanding of the necessary documents, account options, and minimum balance requirements to open an account. It is always advisable to check the current regulations, documents, and balance requirements before opening an account, as they may change. It’s important to choose the account that best suits your financial needs and make sure to maintain the minimum balance requirements to avoid penalties. As always, it’s recommended to consult with the bank’s customer service for further clarifications.

More from KSAexpats.com: