SOCPA Registration

SOCPA stands for “Saudi Organization for Certified Public Accountants“. According to the new regulations applicable from 31-08-2019, it is mandatory for all accounting professionals living and working in Saudi Arabia to register with SOCPA.

SOCPA Registration is Mandatory for Iqama Renewal

According to the new regulations, if any Iqama under accounting professions will not be renewed until the person completes the registration with SOCPA.

Advantages of SOCPA Registration

The SOCPA offers numerous advantages and benefits to registered professionals, including the following:

1- 30% discount on specialized training courses.

2 – Attend many gatherings, conferences, lectures and workshops organized by SOCPA.

3 – Get SOCPA magazine “The Accountants”.

4. Enjoy the benefits of membership in obtaining SOCPA professional and scientific.

5. Discounts on SOCPA’s partners and those who grant special discounts on their services to SOCPA’s registered professionals.

6 – Facilitate dealing with those official bodies that require registration with SOCPA.

SOCPA Registration is mandatory for the following professions:

- Internal Audit Director

- Cost clerk

- Cost Accountant

- Finance Clerk

- General Accountant

- Director, Zakat & Tax Department

- Internal Auditor

- Accounts and Budget Manager

- Senior Financial Auditor

- Director G.A of reviewing

- Director – Financial and Accounting Affairs

- Accounts Auditor

- Accounts auditing technician

- Director – Financial Reporting Department

- General Accounts Technician

- Chief of internal auditing programs

- Financial Audit Supervisor

- Cost Accounting Technician

- Financial Controller

Prerequisite requirements for Professional Registration:

Persons meeting with any of the following qualifications may join SOCPA professional registration:

1. Bachelor degree or higher qualification in accounting.

2. Post-secondary accounting diploma.

3. A graduate of one of the faculties of administrative sciences and passed at least 15 academic hours in accounting, however, those who do not complete the above mentioned 15 academic hours are required to:

3.1 Attend accounting, auditing, Zakat and tax fellowship courses which, all together, are equivalent to nine academic hours. or

3.2 Complete required hours bypassing topics equivalent to (15) hours in accounting or auditing at one of the recognized universities.

4- Holds one of the following professional certificates:

* American Institute of Certified Public Accountants (AICPA).

* Institute of Chartered Accountants in England and Wales (ICAEW).

* Institute of Chartered Accountants of Canada (CICA).

* Institute of Chartered Accountants in Australia (CA-Australia).

* Association of Chartered Certified Accountants in London, UK (ACCA).

* Institute of Chartered Accountants of Pakistan (ICAP).

* Institute of Chartered Accountants of India (ICAI).

* Institute of Management Accountants (IMA) of the United States of America (CMA).

* Institute of Certified Internal Auditors (IIA) in the United States of America (CIA).

Requirements for Professional Registration:

Those who wish to obtain professional registration shall provide the following:

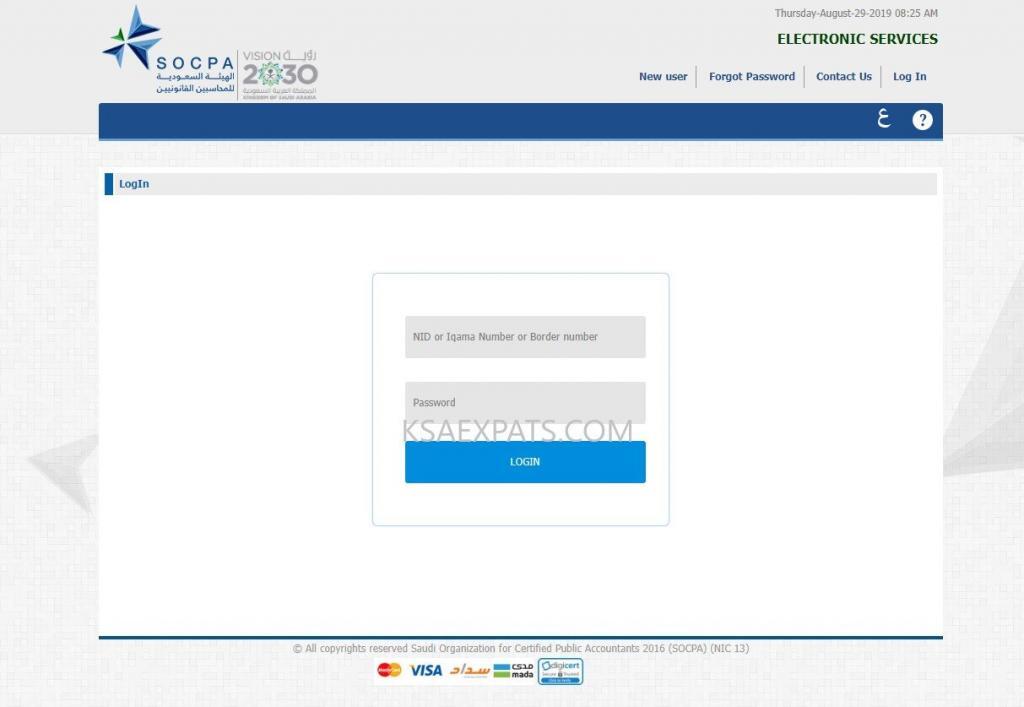

Visit the SOCPA electronic service site and make an account (new user). and then submit the following requirements:

1 Attach a copy of the scientific certificate (all certificates issued outside the Kingdom must be certified by the Ministry of Education).

2 Attach a copy of the identity card (valid).

3 Attach a copy of the passport (for non-Saudis).

4 Attach a personal photograph.

5 Payment of professional registration fees is as follows:

– 315* SR for Registration fees and 525* SR for verification of certificates issued outside the Kingdom, only for the first year.