Updated No Claim Discount (NCD)

In a bid to promote a safe driving culture and enhance the insurance sector in Saudi Arabia, Najm for Insurance Services, in collaboration with the insurance supervision department of the Saudi Central Bank (SAMA), has introduced an updated No Claim Discount (NCD) service. This article sheds light on this recent development and how it aligns with the country’s Vision 2030 goals.

Driving Towards Vision 2030

Saudi Arabia’s Vision 2030 aspires to stimulate growth in various sectors, including the financial sector. One of the crucial steps towards achieving this vision is increasing the motor insurance penetration. With the launch of the updated NCD service, there is now an enhanced emphasis on the significance of safe driving and its direct impact on insurance premiums.

You Might Also Like: How to Check Vehicle Insurance Validity Online

Benefits of the Updated NCD Service

The newly introduced NCD service aims to:

- Motivate Renewals: Encourage policyholders across all segments to renew their policies before they lapse.

- Promote Safe Driving: Incentives drivers to avoid accidents, thereby maintaining a claim-free record. With a spotless record, policyholders can avail a whopping 60% discount on their insurance policy rates.

- Continuous Coverage: Stress the importance of maintaining continuous insurance coverage for all vehicles owned by an individual.

How NCD Rates are Determined

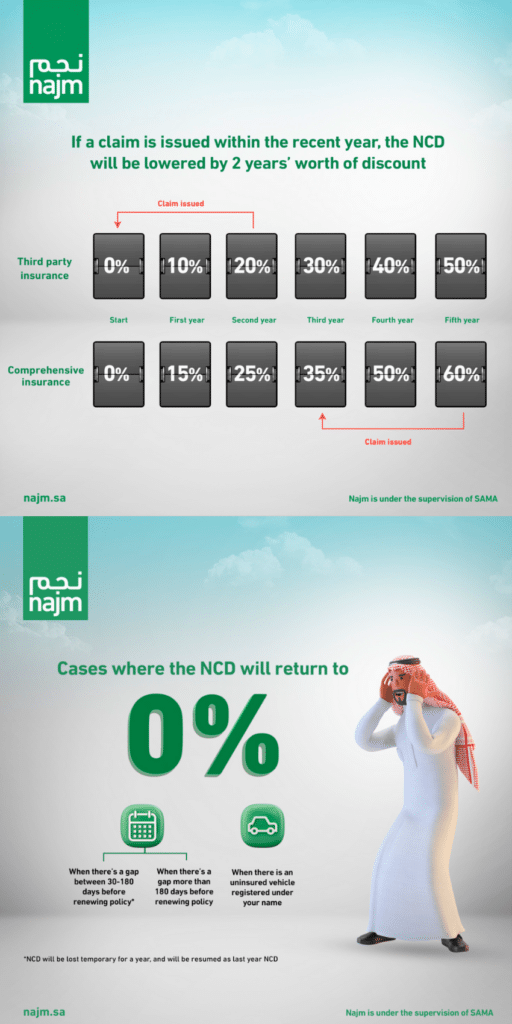

The NCD rate on insurance policies sees an increment based on the number of claim-free years coupled with coverage continuity. However, there are specific conditions under which the NCD can be affected:

1. Gap in Insurance Coverage:

- Up to 30 days: If a new policy is purchased within 30 days after the previous policy expires, the NCD remains unaffected.

- 30-180 days: For this period, the specific vehicle will temporarily lose its NCD for one year. Yet, the record remains, and the NCD will be reinstated upon renewal the next year. It’s worth noting that other vehicles under the same policyholder won’t be impacted as long as their policies are renewed on time.

- Beyond 180 days: NCD will be forfeited for all vehicles if the policy lapse exceeds 180 days.

2. Claims:

If a claim is made, the NCD for all vehicles under that policyholder will be reduced by two years.

3. Transfer of Eligibility:

Eligible NCDs can be transferred to newly purchased vehicles.

As per the Saudi Central Bank’s directives, Najm is responsible for determining the NCD rate, and this can be accessed via its official website or the Najm App.

Key NCD Conditions at a Glance

- Claim Vs. Accident: Only claims will affect the NCD, not mere accidents.

- Eligibility Period: Policyholders must have an active policy for at least 10.5 months to be eligible for the next NCD level.

- Vehicle Sale: If a vehicle is sold without canceling the policy before 10.5 months, eligibility for the next NCD level remains.

Automated Enforcement of Insurance Violations

Starting from 01 Oct. 2023, the Traffic Department has taken a digital leap. The enforcement of “no valid vehicle insurance” violations has become entirely automated. This change will apply to all road vehicles immediately when they lack valid vehicle insurance.

Keep Reading: List of Traffic Violations and Penalties in Saudi Arabia 2023

The General Traffic Department urges all citizens and residents to adhere to traffic rules and ensure their vehicles are insured, ensuring their rights are protected in the event of accidents.

In Conclusion

The updated NCD service is a step in the right direction, promoting a culture of safe driving and ensuring that the insurance sector thrives. It not only incentives safe driving habits but also educates policyholders about the implications of policy lapses and claims. As the nation steers towards the goals of Vision 2030, such initiatives play a pivotal role in shaping a responsible and aware community.

Explore More: