Credit card debt is a serious financial issue, especially for expatriates who have left Saudi Arabia. Unresolved balances can lead to serious consequences if not addressed. This article aims to help expatriates in this situation by providing tips on settling their outstanding debt from abroad.

Understanding the Implications of Credit Card Debt

Credit cards are convenient and useful financial tools, but their misuse or mismanagement can lead to significant debt. This is particularly concerning for expatriates who might leave Saudi Arabia without fully settling their credit card balances. Various reasons, including sudden relocation or financial difficulties, can contribute to this situation.

When a cardholder fails to make payments for 90 days past the due date, the account status changes to “default” (Arab News, 2018). Consequently, the bank or financial institution will restrict the use of the card. For expatriates who have left the kingdom with unsettled balances, it’s crucial to address this issue promptly to avoid further complications.

Also Read: How to Check Your Credit Score in Saudi Arabia

Steps to Settle Your Debt from Your Home Country

If Your Account is Still Active

If your credit card account is still active and not fully settled, the first step is to contact your bank or financial institution for guidance. You can settle the outstanding amount by transferring funds from your home country. This requires the beneficiary’s name, IBAN number, SWIFT code, and address. Once the payment is made and the card is closed, it’s advisable to obtain a No Objection Certificate (NOC) from the bank. This document serves as proof of debt clearance and can be valuable for future financial dealings.

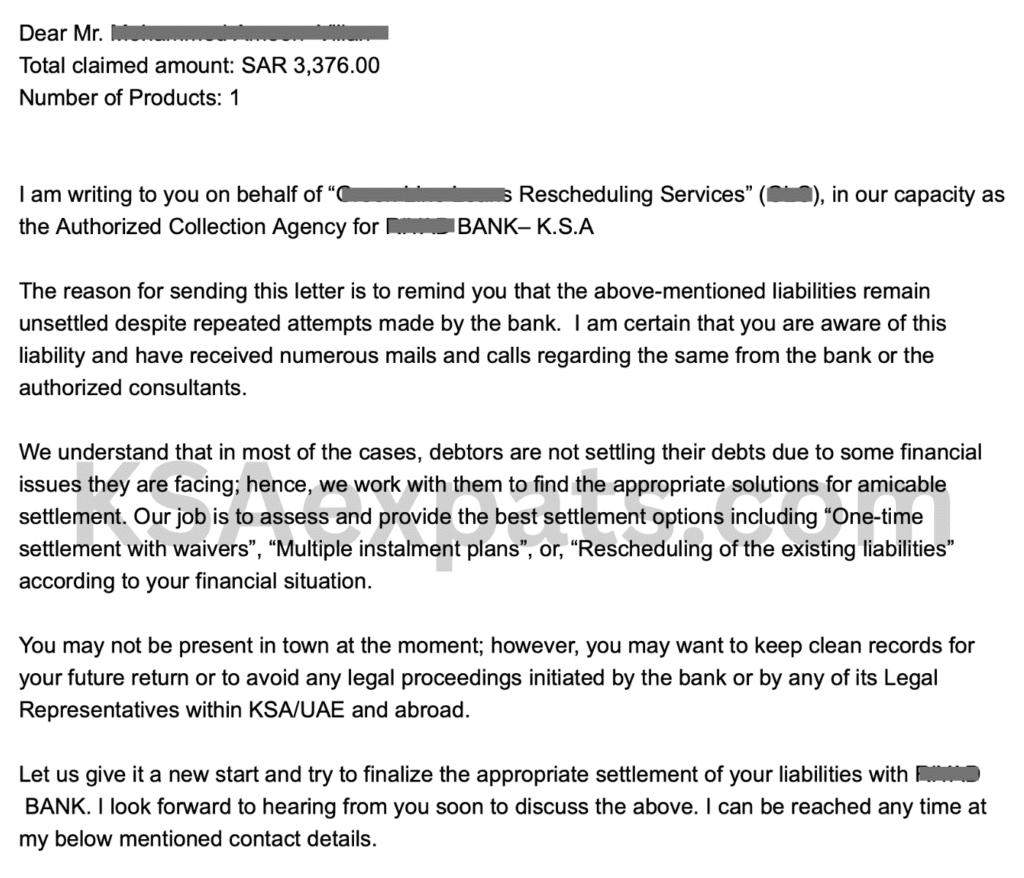

Dealing with Debt Collection Agencies

In cases where the debt is older, banks may assign a debt collection agency to recover the owed amount. These agencies typically attempt to contact debtors through email or phone, using the contact information provided at the time of account opening. If you receive such communications, verify the claim by contacting the bank’s customer care directly, using contact information available on the bank’s website.

Negotiating a Repayment Plan

When dealing with a debt collection agency, you can negotiate a repayment plan that suits your financial situation. Agencies generally offer options to repay the debt in some installments or a one-time payment at a discounted amount. Upon agreeing to the terms, you’ll receive the necessary bank details to transfer the money to Saudi Arabia. After making the payment, it’s important to send the payment receipt to the collection agency for verification. Once confirmed, the agency will provide you with an NOC, confirming the settlement of your debt.

In conclusion, settling credit card debt from abroad requires understanding the process and taking proactive steps. By communicating with your bank or dealing with debt collection agencies, you can negotiate a repayment plan that works for you. Remember, settling your credit card debt not only relieves financial burden but also helps maintain your creditworthiness for future endeavors.