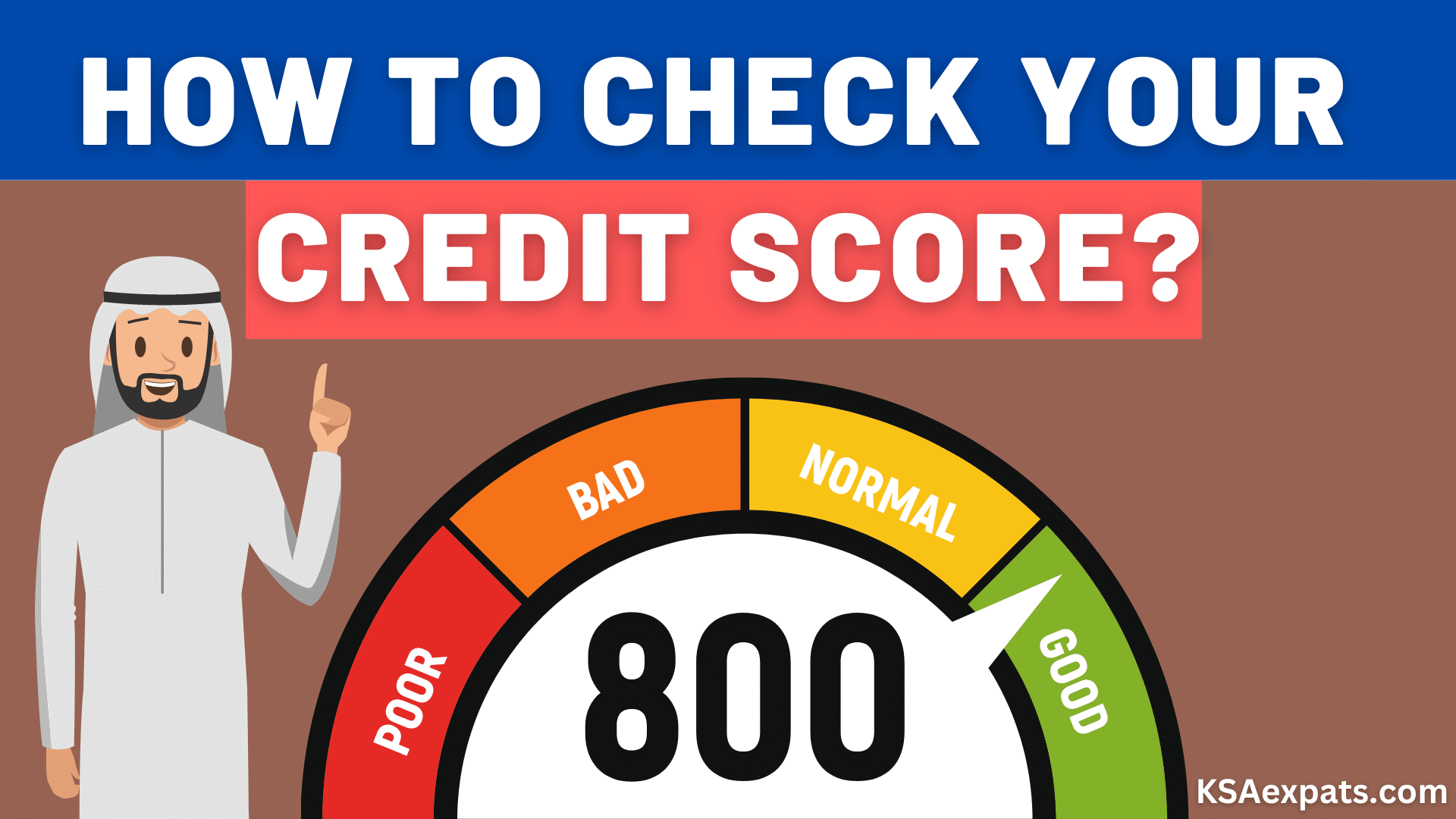

SIMAH Credit Report in Saudi Arabia

Understanding your credit score is essential for managing your financial health, particularly if you plan to apply for loans or credit cards. In Saudi Arabia, the credit score is maintained by the Saudi Credit Bureau (SIMAH). In this article, we’ll discuss the importance of your credit score, how to check it in Saudi Arabia, and ways to improve it for a better financial future.

The Importance of Credit Scores in Saudi Arabia

A credit score is a three-digit number that represents your creditworthiness, based on your credit history. Banks and financial institutions in Saudi Arabia use this score to determine whether to approve loans, credit cards, and other forms of credit. A good credit score means that you are less of a risk to lenders, and you are more likely to be granted loans or credit cards with favorable terms and interest rates.

Also Read: Top SABB Bank Credit Cards in 2023

How to Check Your Credit Score in Saudi Arabia

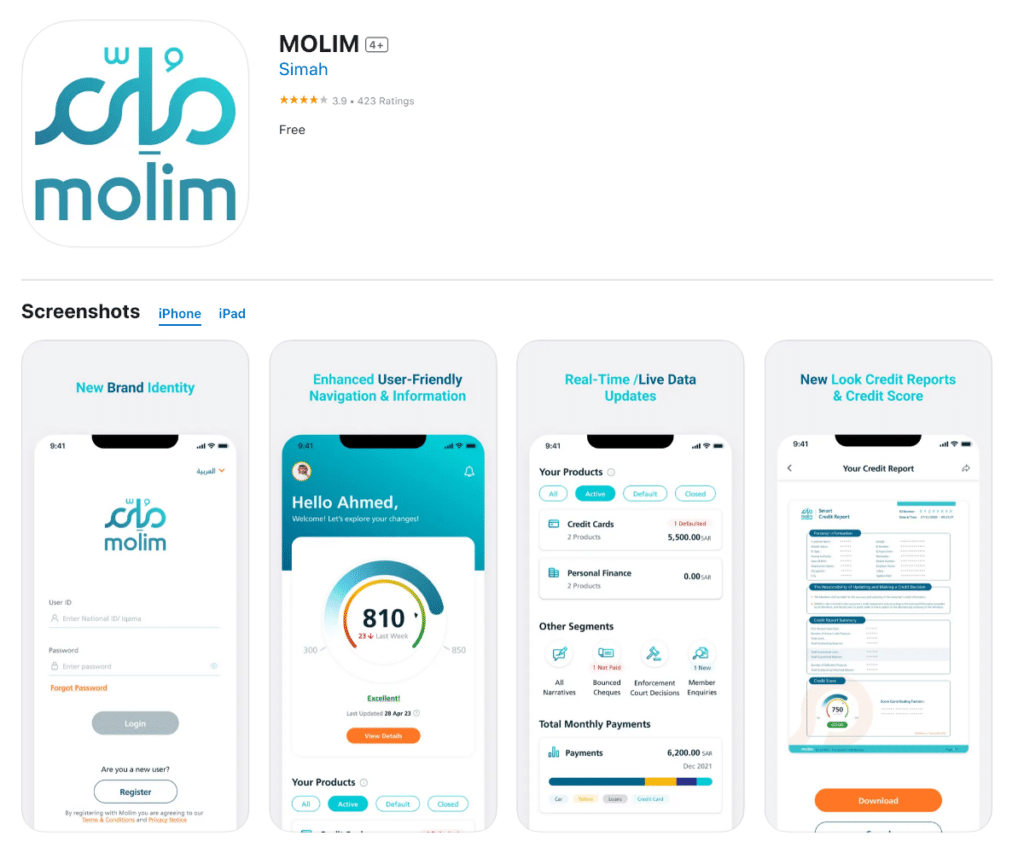

In Saudi Arabia, you can check your credit score through the MOLIM website by SIMAH. To access your credit report, follow these steps:

- Register with MOLIM: First, you need to register with MOLIM to access their online portal. Visit their website (https://eservices.molim.sa/) and select on the “Register” option. Fill in the required information and create a new account.

- Complete the identity verification: Upon registration, you’ll be asked to complete an identity verification process. This may involve providing your National ID or Iqama number, mobile number, and email address.

- Request your credit report: Once your identity is verified, log in to your SIMAH account using your username and password. Navigate to the “Request Credit Report” section and follow the on-screen instructions.

- Pay the credit report fee: There are different packages for obtaining your credit report. You can choose one of them and pay the fee using a credit or debit card.

- Access your credit report: After payment is confirmed, your credit report will be available for download in PDF format. You can also choose to have it emailed to your registered email address.

Besides the MOLIM website, you can also access your molim credit score using the MOLIM Apps, available for download from the Apple Store or Google Play Store.

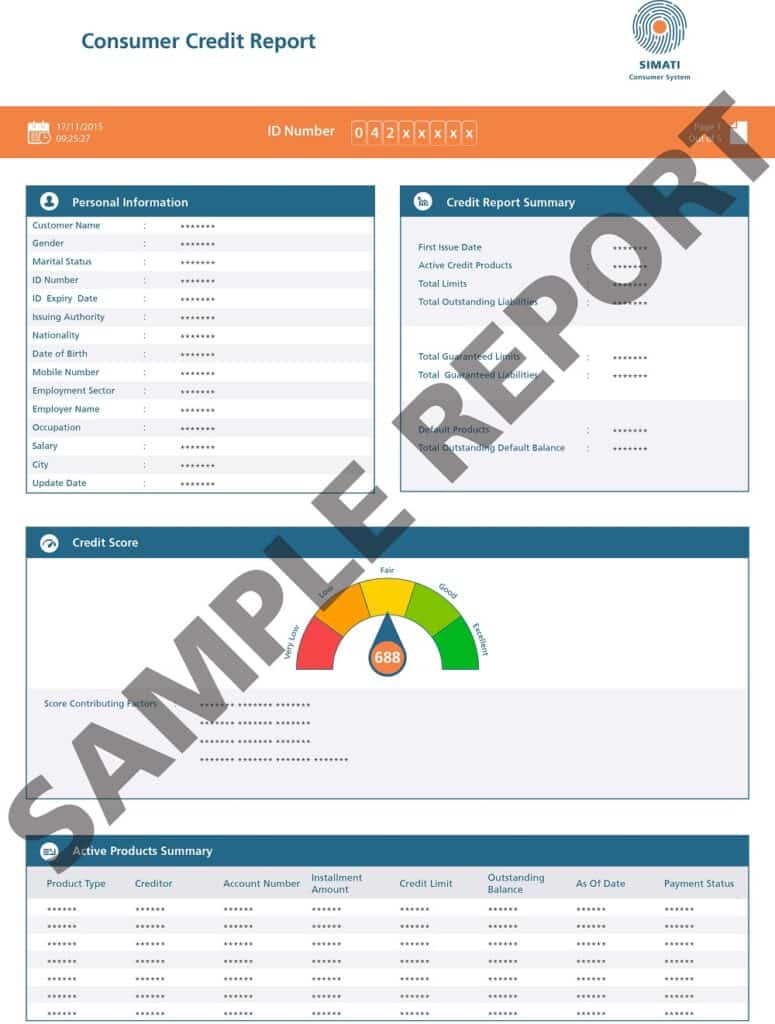

Understanding Your Credit Report

Your credit report will contain various sections, including personal information, a summary of your credit history, and details of your credit accounts. The most important aspect of the report is your credit score, which typically ranges from 300 to 850. A higher score indicates better creditworthiness, while a lower score signifies a higher risk for lenders.

Improving Your Credit Score

If your credit score is low, you can take various steps to improve it. Here are some suggestions:

- Pay your bills on time: Late or missed payments can significantly impact your credit score. Ensure that you pay all your bills, including loans, credit cards, and utilities, on time.

- Keep your credit utilization low: Try to maintain a low credit utilization ratio, which is the percentage of your available credit that you’re using. A high ratio can negatively affect your score.

- Don’t apply for too much credit: Applying for multiple loans or credit cards in a short period can lower your credit score. Limit your credit applications and only apply for credit when necessary.

- Monitor your credit report: Regularly check your credit report to ensure that all the information is accurate. If you find any errors or discrepancies, report them to SIMAH immediately.

Also Read: Best Al Rajhi Bank Credit Cards in 2023

Conclusion

Checking your credit score in Saudi Arabia is a crucial step in managing your finances and securing better financial deals. By understanding your credit score and taking the necessary steps to improve it, you can work towards a more secure financial future in the Kingdom.

More from KSAexpats.com: