For expatriates residing in Saudi Arabia, having a valid health insurance policy is mandatory. This is not just a suggestion; it is a requisite for obtaining or renewing your Iqama, the permit that authorizes you to live and work in the country. Checking your health insurance status is simple. This can be easily done online via the Council of Health Insurance (CHI) website or through their mobile application, “Daman”. We will guide you through this process step by step.

How to Check Iqama Insurance Status on the CHI Website

To check the status of your Iqama insurance, follow these steps:

- Go to the CHI’s Iqama insurance check page at https://eservices.chi.gov.sa/Pages/ClientSystem/CheckInsurance.aspx

- Select your preferred language (English or Arabic)

- Enter your Iqama number in the Identity Number field.

- Enter the image code, and click the “OK” button to verify your insurance status.

- On the next page, you can view detailed information about your health insurance policy, including the insurance company, medical network, policy number, class, deductible rate, expiration date, beneficiary type, and name.

Checking Iqama Insurance Status on the CHI App

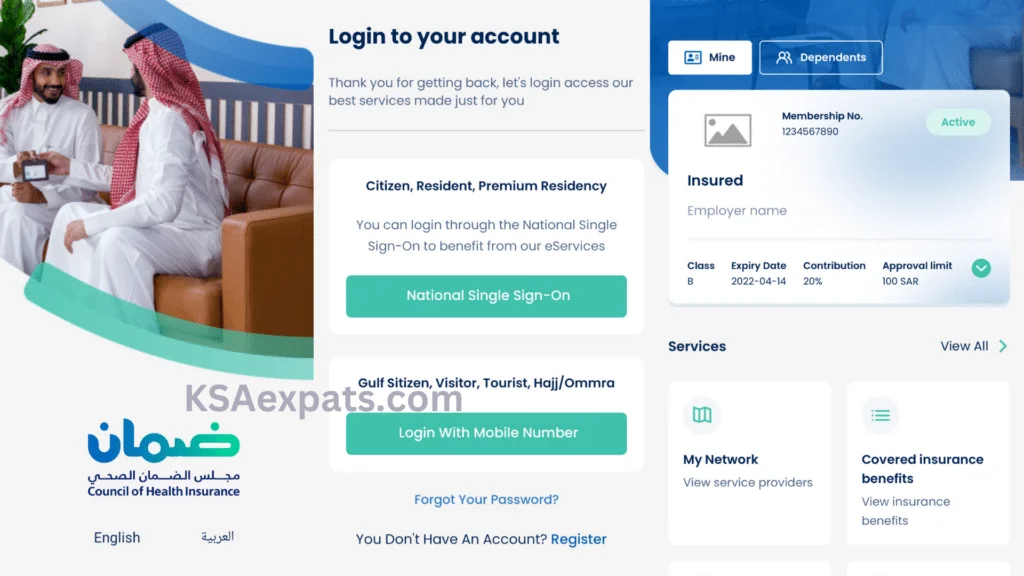

You can also check your Iqama health insurance status using the “Daman” CHI app. The app can be downloaded from the Google Play Store or the Apple App Store. Here are the steps:

- Download the CHI app.

- Choose the English language option.

- Log in using your “Nafath” account.

- On the home screen, you can view your insurance information.

With the CHI “Daman” app, you can view insurance details for yourself and your family, add the insurance card to your digital wallet, and see approved medical networks. You can also check your insurance rights and benefits, manage inquiries and complaints, and even contact the authority.

Conclusion

In conclusion, it is important to keep track of your health insurance as an expat with an Iqama in Saudi Arabia. Thanks to the Council of Health Insurance’s website and the “Daman” app, you can now quickly check your insurance status.

Also Read:

- How to Check Iqama Expiry Date Online

- Checking Iqama Color Status Online

- Easy Steps to Check Your Family Visa Status Online

- How to Confirm the Status of Hajj Insurance Online

- How to Verify the Status of Visit Visa Insurance Online